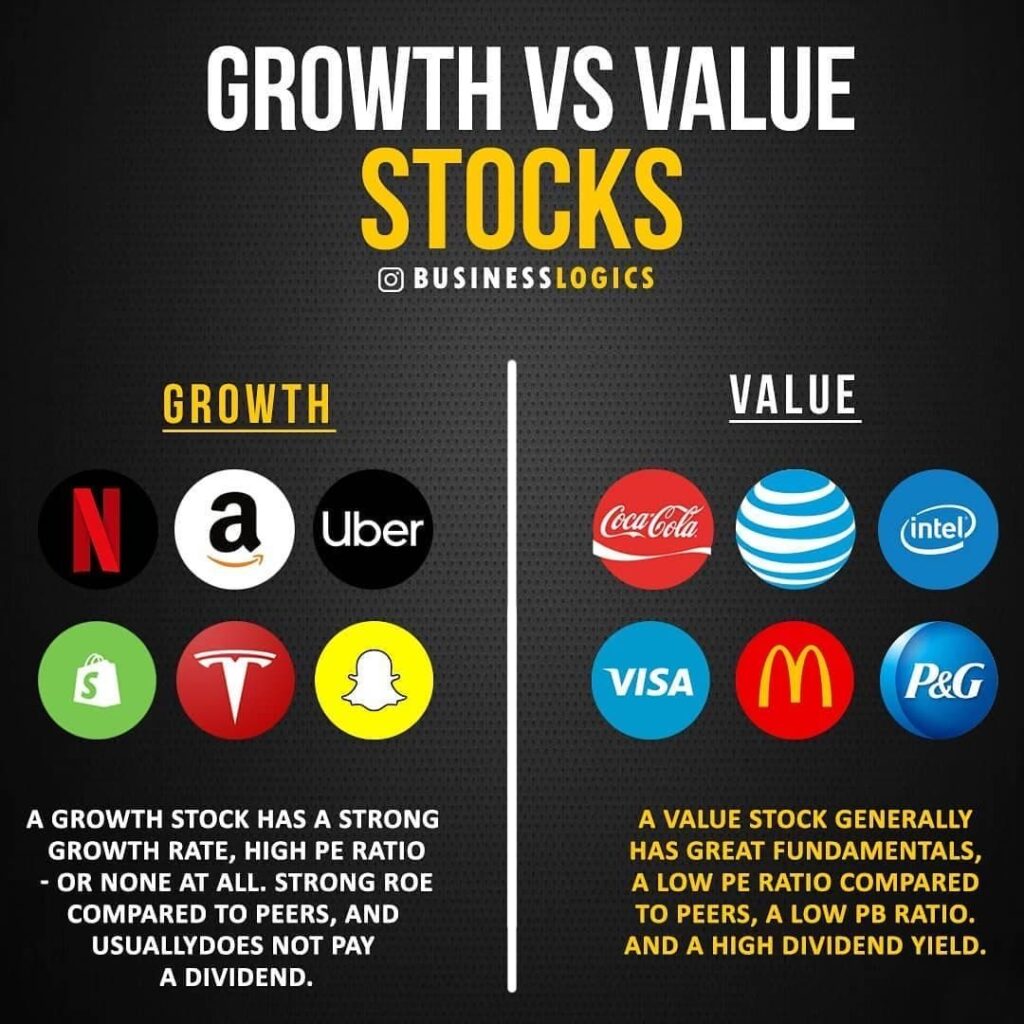

Growth Stocks are the companies that are predicted to become industry leaders and outperform the whole market. These companies have huge potential to earn investors a lot of money.

Value stocks are those companies that are undervalued in the current market. In the investing world, there is a lot of debate about whether growth stocks or value stocks are better.

In this article, we will break down this question.

Growth Stocks

- Growth stocks are those stocks that have the potential to grow and outperform the market, or a segment of the market in the long run.

- The intrinsic value of growth stocks is determined by fundamental analysis.

- Growth stocks can be found as small-cap, mid-cap or even large-cap companies.

- Growth stocks are only considered to be growth stocks before they have reached their full potential.

- These companies have a product or line of products that sell well, have strong management, or are much better than their competitors.

Value Stocks

- Value stocks are larger companies that are trading at an undervalued price.

- They might be undervalued because of a scandal involving higher management, or malpractice within the company. However, in our technological era, news like this fades away.

- Experts believe that the public will forget about bad news quickly, and the price of the stock will rebound.

- If the company has solid fundamentals, then they have a great chance of improving in price.

- Undervalued stocks are identified using cash flow ratios, price to earnings, and book value.

Of course, some stocks can be classified as a blend of these two categories, and there are a lot of grey areas.

Which is better

- Comparing both of these categories is a difficult process. Any results must be evaluated in terms of the time period, and amount of volatility in the market.

- Value stocks are typically lower risk, as they are bigger companies than growth stocks. Even if value stocks don’t reach their target, they provide handsome returns through their dividends.

- Growth stocks are riskier than value stocks. Some of these smaller stocks do not reach the heights they were expected to, and investors may lose a lot of money in these companies. For example, a company with a novelty product might see its business crumble, because the product failed when it entered the market.

- In conclusion, growth and value stocks have their ups and downs. Historically, they are neck and neck, and it is difficult to pick one over the other.