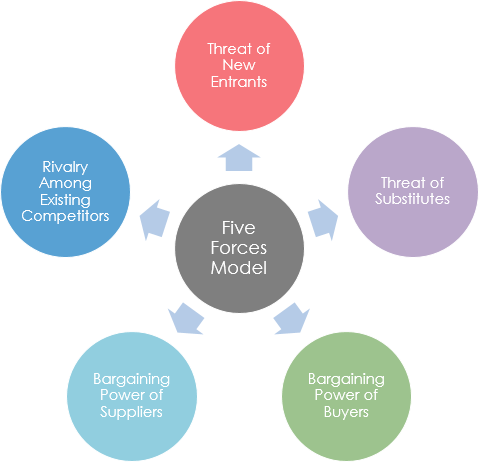

Porter’s Five Forces. Usually, when investors analyze a stock, they look for fundamental ratios, such as P/E, Debt to Equity, and Price to Book ratio. These ratios are great for analyzing the quantitative aspect of stock, but lack on the qualitative side. This is where Porter’s Five Forces fill the gap

What Are Porter’s Five Forces?

- Porter’s Five Forces is named after Harvard Business School professor, Michael Porter. This model was first published in 1980, in his book, “Competitive Strategy: Techniques for Analyzing Industries and Competitors”

- The Five Forces are used to analyze the structure of an industry. It also takes temporary factors into consideration, like new innovations, and growth of the market.

- Here are Porter’s Five Forces

- Industry Competition

- Ease of entry

- Power of consumers

- Power of suppliers

- The threat of substitute products

Porter’s Five Forces; Industry Competition

- This first part refers to the number of companies in the industry. The larger the number of competitors, the fiercer the competition.

- For example, if there are 10 grocery stores in an area, they will try to undercut each other. That way, the store with the lowest prices gets the most sales. This is great for consumers.

- However, the other 9 competitors will have a tough time earning profits, since they sell identical products. If a company has no competitors, they are a monopoly. Basically, they can keep the price at whatever they want, and since the consumer has no alternatives, they have to buy from the monopoly.

- They have greater power over their prices.

Porter’s Five Forces; Ease Of Entry

- A company’s power is affected by new competitors entering the market. The lower the cost to enter and compete in the market, the worse for an established company. Let’s look at an example.

- If there is 1 fruit vendor in your neighbourhood. You will buy fruits from him. The next day, 10 more fruit vendors can set up shop in your neighbourhood.

- They sense profits to be made. It is extremely easy to enter the market. Hence, the price of these goods is elastic, and the company has little power.

- However, if there is one electricity provider in your neighbourhood, it is extremely difficult for another firm to enter this market, and provide electricity.

Porter’s Five Forces; Power Of Consumers

- The power of consumers is the consumer’s ability to drive down prices. It is affected by the number of consumers the company has.

- If a company has a small, core group of consumers, they have high negotiating power, to reduce prices.

- If a company has numerous customers who are not individually important, then they can increase their prices, and the power of consumers is low.

Power Of Suppliers

- The power of suppliers is the supplier’s ability to increase prices of inputs. The fewer suppliers in an industry, the more the company is dependent on suppliers.

- It also depends on the availability of goods. If the suppliers are selling rare materials, they have more power to drive up prices.

- If there are many suppliers, the product is likely to be common, and then the company doesn’t depend on any one supplier.

The Threat Of Substitute Products

- This aspect of Porter’s Five Forces refers to substitute products. Goods that can replace a company’s products pose a threat.

- For example, the price of apples is high. As a consumer who wants to eat fruits, you would naturally switch to substitute fruits, such as oranges, bananas, etc. However, for a diabetic, he needs his insulin.

- There is no other substitute. Hence, companies that sell products with no close substitute have more control over their prices, as compared to exchangeable products.