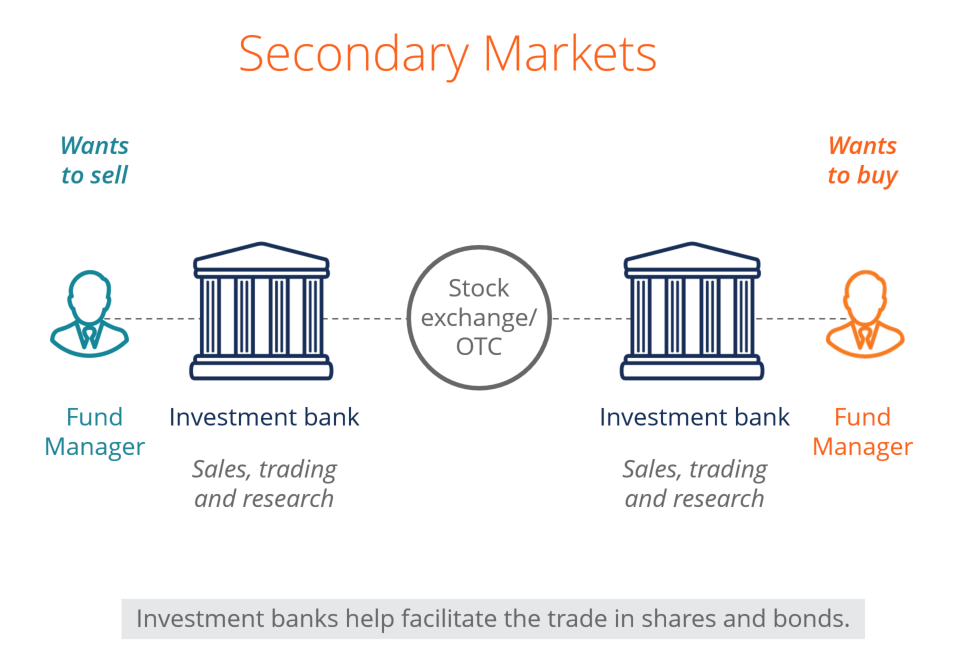

The secondary market is where investors buy and sell securities. The reason it is called the secondary market is very simple.

The shares from the company have been bought by an investor, and then sold by that investor to another person.

It’s essentially like a “second hand” good.

Since the share is no longer being bought directly from the company, this market is known as the secondary market.

All of the stock exchanges in the world are secondary markets. The NSE and BSE fall into this category.

The secondary market is also commonly known as the “stock market”, even though there are other types of secondary markets. For example, bonds, mutual funds, mortgages, etc, are also sold in the secondary market.

Unlike the primary market, where the price of the securities is determined by underwriting groups, the prices in the secondary market are driven by pure supply and demand.

If a company posts large amounts of profit, more investors rush to buy the stock, making the price shoot up. This means that the demand for the stock has risen, and so has the price

On the other hand, investors losing confidence in a company can cause the price of the stock to crash. This happens due to the dwindling demand for the stock.

The number of secondary markets in existence is always increasing, as more and more stock exchanges are established all over the world.

Other markets are also established to trade more financial securities such as bonds and mutual funds. Because of this, several secondary markets exist all over the world.