What is a Cash Flow Statement?

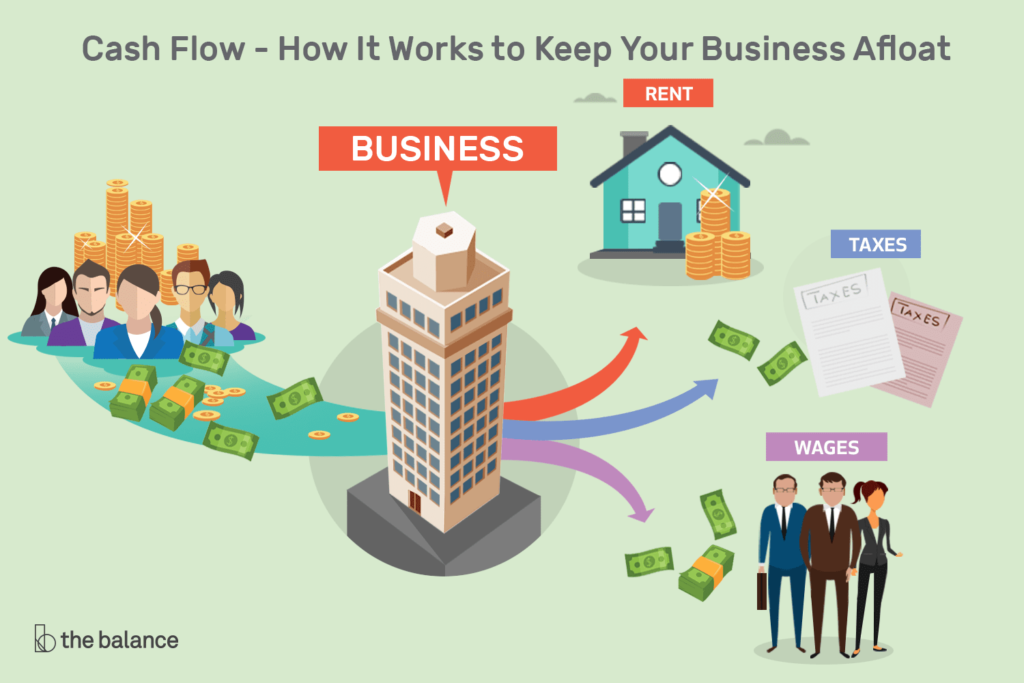

A Cash Flow statement is a financial statement that talks about the cash entering and leaving a company. Just like the profit and loss statement, it describes the transactions held over a period of time.

The cash flow statement tells investors how well the company manages its capital, to pay back debts and fund its operations.

The cash flow statement complements the balance sheet and the income statement (P&L statement)

Investors use the cash flow statement to determine how financially sound a company is.

Creditors, who fund the company, can use this statement to determine how much liquid money the organization has, and how well the company uses it.

Structure of a CF Statement

The three main components of a cash flow statement are concerned with how the company spends money. These components are operations, financing, and investing

The cash flow statement is different from the income statement because it doesn’t cover expenses and revenues. Rather, it just discusses the cash entering and leaving a firm.

Cash flow from operating activities

This segment covers the cash generated from the operating activities of the business. Basically, it covers what income the company receives from their sales. These activities include

- Sales of goods and services

- Income tax payments

- Repayment of loans

- Buying of goods from the supplier

- Wage payments

- Other business expenses

Cash flow from financing activities

Cash from financing activities includes all the cash that was received from investors and banks. This component also includes all the cash that was given back to banks and investors, in the form of dividends, interest, etc.

Changes in the capital are “cash in” when bank loans or investor capital is received and “cash out” when dividends are given.

Cash flow from investing activities

This segment refers to all sources of cash from a company’s investments. Purchasing assets, giving or receiving loans, or other investments. Basically, whenever cash is exchanged for a financial asset.

When assets are sold it’s considered “cash in”, and when they are sold it’s considered “cash-out”.

Limitations of CF Statements

Negative cash flow can raise red flags for some investors. However, poor cash flow can be due to a number of factors. A company may have spent money to invest in its future. Because of this, its cash flow may be negative.

Therefore, investors must compare cash flow statements from different time periods. Hence, they get an understanding of what the company is doing to improve their business, and if their cash management is improving.

You should not look at a cash flow statement on its own. It should be paired up with the other two financial statements, which are the income statement and the balance sheet. This will ensure a complete understanding of the company.